India’s dynamic economy has set its sights on climbing the global ease of doing business rankings, prompting a significant transformation in the commercial and judicial landscape. Within this landscape, corporate litigations stand apart, fuelled by the intricate dynamics of business entities rather than just individuals.

At the heart of this transformation are several pillars aimed at expediting dispute resolution within the corporate realm. The arbitration law, commercial courts, the Insolvency and Bankruptcy Code (IBC), and the National Company Law Tribunal (NCLT) constitute the core of India’s corporate litigation ecosystem. Their collective objective is ensuring swift adjudication of cases and fostering a conducive environment for business operations. All these judicial courts are mutually exclusive and have independent ruling powers within their ambit.

CORPORATE JUDICIAL ECOSYSTEM

Corporate disputes often revolve around the exercise of board powers, actions, or their failure to act. They can manifest in conflicts between boards and shareholders, directors, and executive management, or even among directors themselves. When these disputes spill into the public domain or escalate into litigation, they signal governance lapses within the company—a critical aspect in maintaining investor confidence and market stability.

Recognizing the pressing need to streamline India’s litigation framework, policymakers embarked on a journey to alleviate the burden on high courts and the Supreme Court. Specialized tribunals like the NCLT and the National Company Law Appellate Tribunal (NCLAT) were established under the Companies Act to handle core company litigation, replacing erstwhile bodies like the Company Law Board (CLB) and the Board for Industrial and Financial Reconstruction. The NCLT or “Council” is a quasi-legal position made under the Companies Act, 2013 to deal with corporate common questions emerging under the Act. Furthermore, the Companies Act endeavours to strike a balance between the rights of majority and minority shareholders. While acknowledging the rule of the majority, it also safeguards minority interests through well-defined minority rights, thus ensuring equitable treatment and protecting minority shareholders from potential exploitation. Judicial courts play a pivotal role in maintaining this equilibrium and addressing the concerns of stakeholders.

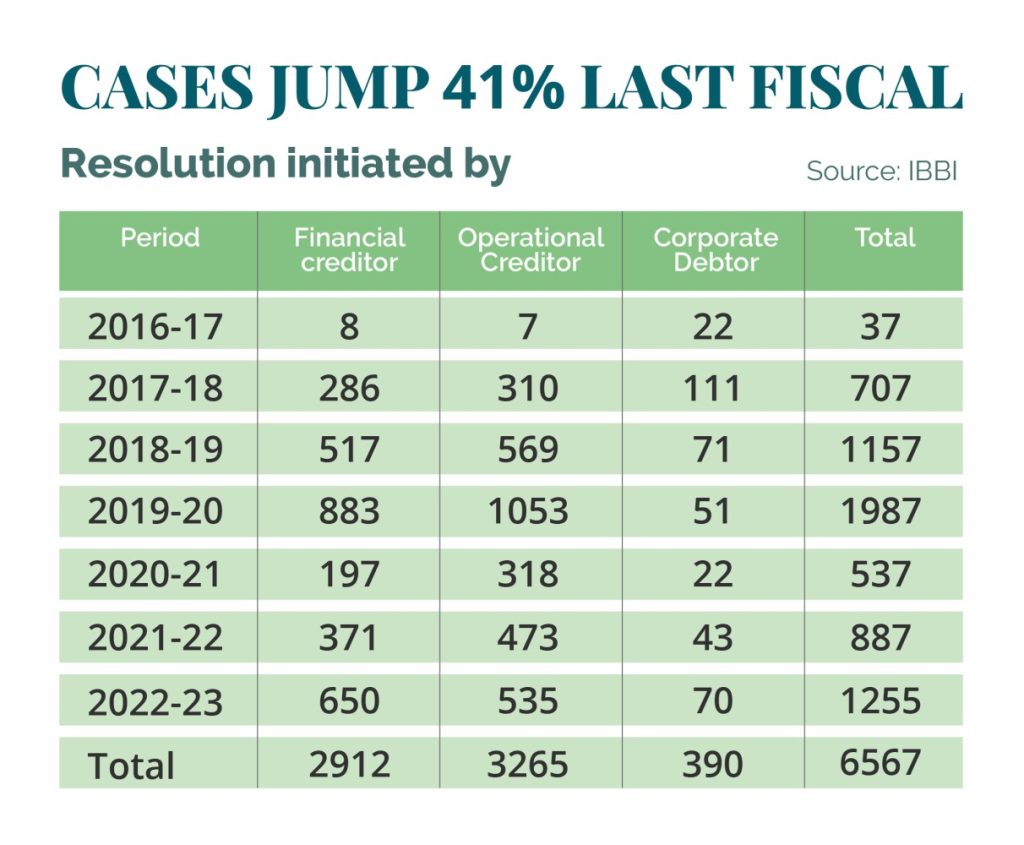

The Insolvency and Bankruptcy Code stands as another testament to India’s commitment to expedited dispute resolution. By enforcing a time-bound insolvency process, the code aims to facilitate a faster turnaround and smoother bankruptcy proceedings. This, in turn, enhances investor confidence and provides a conducive environment for business growth and investment. The fastest resolution so far in an IBC case, the insolvency resolution of Bhushan Steel was completed in just 10 months flat. The case was admitted for resolution in July 2017 and got the approval in May 2018. The bidding war between Tata Steel and JSW Steel fetched lenders a 63 percent recovery, where Tata Steel bid INR 35,200 crore against Bhushan Steel’s debt of INR 56,051 crore.

Despite these commendable efforts, challenges in implementation persist. The success of these reforms hinges on effective execution and institutional capacity building. As per the latest information available, 21,205 cases were pending with NCLT benches as of 31.01.2023, including 12,963 cases under the Insolvency and Bankruptcy Code (IBC), 1,181 cases of Merger and Amalgamation (M&A), and 7,061 other cases.

The NCLT benches are burdened with large number of cases, leading to delays in the disposal of matters. The infrastructure and manpower at various benches need further improvement to handle the increasing workload effectively. Nevertheless, the courts have played a crucial role in promoting a more streamlined and efficient resolution process for corporate disputes and insolvency cases. The decisions of these courts have a significant impact on the corporate sector, shaping jurisprudence and providing clarity on various legal provisions.

Alternative Dispute Resolution (ADR) methods like conciliation, mediation, and Lok Adalats have shown promise in addressing issues in India’s traditional court system but have not scaled widely. COVID-19 restrictions have further limited their effectiveness and that paved way for Online Dispute Resolution (ODR) or e-ADR as a key alternative. However, it is crucial for ODR platforms and courts to collaborate, share data, and build a cohesive dispute management system.

In conclusion, India’s corporate disputes ecosystem has undergone a remarkable evolution, driven by the imperative of efficiency and governance. While significant strides have been made, continued vigilance and concerted efforts are necessary to realize the full potential of these reforms. By fostering a robust dispute resolution framework, India can bolster investor confidence, attract foreign investment, and propel its economy towards sustained growth and prosperity.