One of the most eagerly awaited aspect in the budget for every citizen is the announcement of tax proposals. However, this anticipation in the FY 2024-2025 interim budget took us by surprise when Hon’ble Finance Minister Nirmala Sitharaman revealed no proposed amendments in the Income-tax law. Nonetheless, there was a small hope with unveiling of relief measures for all categories of small taxpayers, indicating that outstanding tax demands of Rs. 25,000/- per year up to FY 2009-10 and Rs. 10,000/- per year for FY 2010-11 to 2014-15 would be withdrawn.

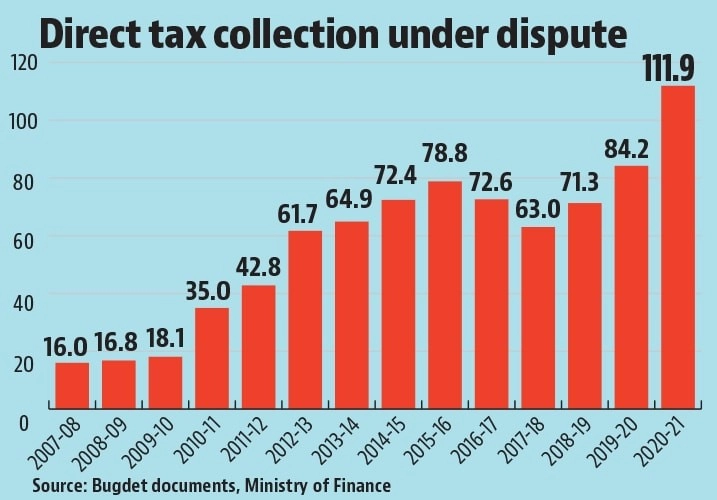

A staggering 2.68 crore disputed tax demands, including Income Tax, wealth tax, and gift tax, totalling Rs. 35 lakh crores, are pending across various legal forums as confirmed by Shri. Sanjay Malhotra, Revenue Secretary at the Department of Revenue, Ministry of Finance. Among these, 2.1 crores have demands up to Rs. 25,000/-, with cases dating back to 1962. Furthermore, approximately 58 lakh demands qualify for relief up to FY 2009-10, and 53 lakh demands are eligible for the period spanning FY 2010-11 to 2014-15. The image below depicts the rising trend of the direct tax collection under dispute.

*Amounts in INR lakh crores Data available only till 2020-21

The budget announcement lacked clarity regarding the withdrawal of demands, leading to significant uncertainty. Questions arose regarding whether the relief amounts of Rs. 25,000/- and Rs. 10,000/- would also encompass the interest component or only the principal. Furthermore, it remained unclear if taxpayers with demands exceeding Rs. 25,000/- or Rs. 10,000/- would receive partial relief, and if there would be an upper monetary limit for demand withdrawal.

Addressing these concerns, the Central Board of Direct Taxes (CBDT) issued a detailed explanation on February 13, 2024. According to it, outstanding demands under the Income-tax Act, 1961, Wealth-tax Act, 1957, and Gift-tax Act, 1958 as of January 31, 2024, will be withdrawn from the date such demands were raised or modified for the respective Assessment Year. However, there is a cap of Rs. 1,00,000/- per taxpayer on the principal component of tax demand under these Acts. The order excludes any outstanding demands related to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) under the Income-tax Act, 1961.

Regarding the computation of the monetary limit of Rs. 1,00,000/-, it is specified that the limit will apply from earlier assessment years to subsequent assessments, provided the demand does not exceed the ceiling of Rs. 1,00,000/-. Additionally, demands exceeding Rs. 10,000/- or Rs. 25,000/- will be disregarded for the purpose of this calculation.

It is emphasized that the withdrawal of the claim does not grant taxpayers the right to claim credit or refunds for taxes prior to withdrawal. Moreover, it does not impact any ongoing criminal proceedings under any law and does not confer any benefit or immunity to the taxpayer or assessee in such proceedings.

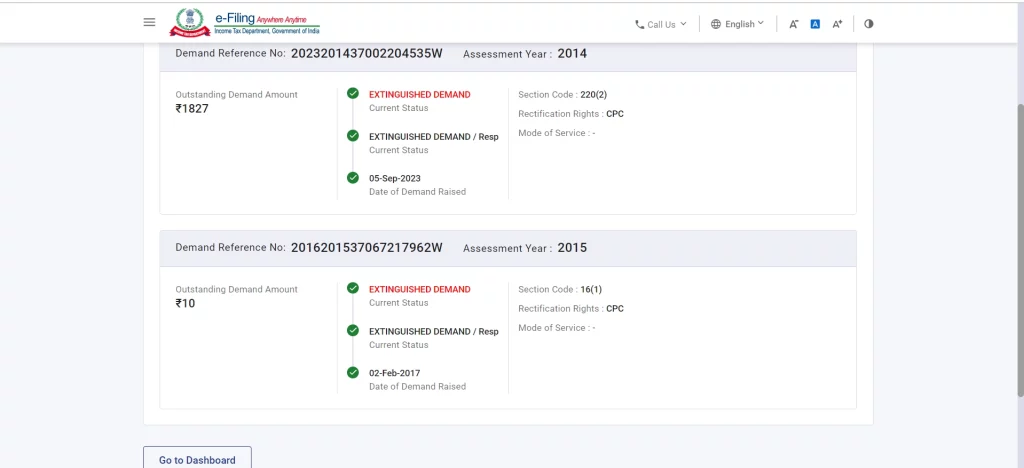

Following the CBDT’s order, the Income-tax E-filing portal of taxpayers displayed “Extinguished Demand” highlighted in red under the outstanding tax demand tab as under:

The Government’s decision is welcome move as:

- Many outstanding demands date back to as early as 1962 and when taxpayers attempted to rectify or contest these demands with tax authorities, the income-tax officers, at various instances lacked sufficient information to verify their claims.

- The government typically also incurs significant costs in pursuing small demands and this move will reduce such spends.

- This has offered relief to taxpayers, as many tax refunds were previously withheld due to unresolved demands from previous years.

This move is likely to benefit 1 crore tax payers and, in our view, this action solidifies the Government’s assertion of recognizing and honouring taxpayers, as well as underscores the importance of fostering a favourable business environment in India. By addressing unresolved tax demands and facilitating the release of withheld tax refunds, the government has initiated a positive message to both domestic and international investors regarding its commitment to a fair and consistent regulatory framework.