In 2023, Mergers and Acquisitions (M&A) activity in India witnessed a remarkable surge where Indian companies successfully closed more than 90 M&A transactions, collectively valued at approximately US$ 32 billion. Notably, sectors such as renewable energy, infrastructure, logistics, and manufacturing have prominently featured, constituting a significant portion of deals over the past 18 months.

Despite challenges such as high-interest rates, macroeconomic uncertainty, regulatory scrutiny, and geopolitical risks plaguing the global market, India’s M&A activity demonstrated remarkable resilience throughout 2023. Optimistic projections for 2024 indicate that the country is poised to maintain its momentum in deal-making, further underscoring its attractiveness in the M&A sector. This buoyancy solidifies India’s status as a premier destination for strategic acquisitions and corporate consolidations, reaffirming its enduring appeal in the foreseeable India.

In India, the Competition Act, 2002 (as amended) (“the Act”) serves as an important legislation that regulates M&A activities. This Act prohibits anti-competitive agreements that may significantly adversely affect competition within India. The Competition Commission of India (CCI) is empowered under this act to investigate anti-competitive agreements and instances of dominant positions, such as predatory pricing, and declare them void. Moreover, the Act prohibits any person or enterprise from engaging in a combination that would result in or likely result in a significant adverse impact on competition within the relevant Indian market. Such combinations shall be deemed void. A combination, in this context, encompasses mergers, amalgamations among enterprises, or the acquisition of control, shares, voting rights, or assets of an enterprise by another entity.

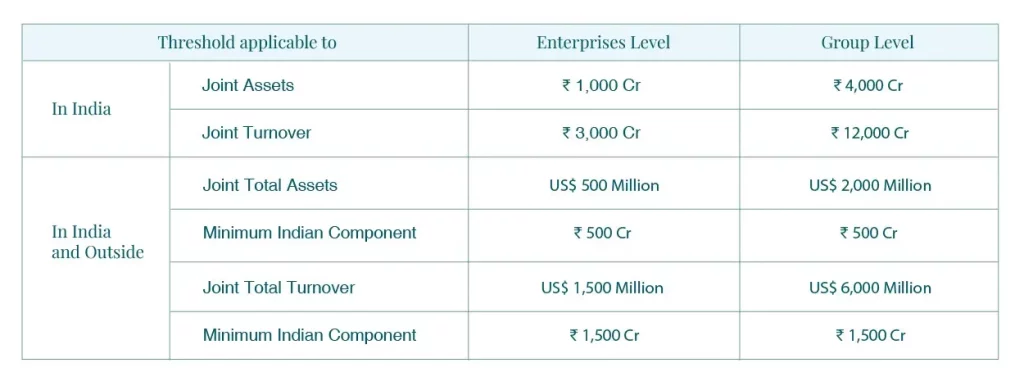

Not all M&A activities necessitate notification to the Competition Commission; only combinations surpassing specified thresholds require prior notification and approval. The act delineates thresholds for enterprises and groups based on assets and turnover. If these thresholds are surpassed, it necessitates notifying the CCI. Presently, the thresholds stand as follows:

On March 7, 2024, the Central Government extended the de minimis clause, exempting acquisitions, mergers, or amalgamations involving target enterprises with assets not exceeding Rs. 450 crores or turnover not exceeding Rs. 1,250 crores in India from the purview of the Act. This exemption is applicable for 2 years from the date of notification in the official gazette.

Reliance & Disney Merger:

On February 28, 2024, Reliance Industries Limited and Walt Disney finalized a merger agreement, creating a media giant valued at US$ 8.5 billion (Rs. 70,352 crore). Nita M Ambani is slated to chair the combined entity’s board, with Reliance and its affiliates holding a majority 63.16% stake (16.34% by RIL, 46.82% by Viacom18), while Disney retains 36.84%. Given this merger exceeds the threshold, notifying the CCI and obtaining approval is imperative. Post-merger, the entity secures exclusive rights to distribute Disney films in India and access over 30,000 Disney content assets, enhancing its entertainment offerings. With a collective total of 120 TV channels and two digital streaming platforms, Disney and Reliance aim to reach 750 million users in India. Reliance and Disney’s TV viewership share in the top 10 channels is estimated to be 40% as per the Broadcast Audience Research Council (BARC). Disney+ Hotstar maintained its dominance in the Indian OTT market with a 24% market share in Q4 2023, while Jio Cinema held a 6% share. Together, the joint venture is poised to capture a significant 30% market share in the OTT sector, surpassing Prime Video’s 22% and Netflix’s 13%. The proposed merger is subject to obtaining regulatory, shareholder, and customary approvals, with an expected completion timeline in either the fourth quarter of the calendar year 2024 or the first quarter of the calendar year 2025.

The CCI may scrutinize the proposed merger entity’s ability to increase prices for advertisers, Distribution Platform Owners (DPOs), and viewers, particularly in channels with substantial market share. Additionally, the CCI might express apprehensions regarding potential discriminatory pricing practices with DPOs.

Over the past two to three years, the CCI has shown a readiness to consider alternative forms of remedies, if they adequately tackle competition concerns. The CCI has indicated its departure from a one-size-fits-all approach, instead opting to tailor remedies meticulously to address the specific harm identified in each case.

Since its inception, the Competition Commission of India (CCI) has reviewed more than 1,000 transactions, successfully resolving 99% of them. Notably, only eight cases, accounting for less than 1% of the total, have advanced to a comprehensive Phase II investigation, while the majority have been cleared during Phase I. Importantly, there hasn’t been a single instance of a transaction being blocked thus far. Instead, approvals have been granted in certain cases following the implementation of structural or behavioural remedies, determined in consultation with the involved parties to address potential anti-competitive impacts on markets. This underscores the CCI’s predominantly pro-business stance.

In October 2022, the CCI approved the consolidation of specific entities within the Sony Corporation group and Zee Entertainment Enterprises Limited. However, this approval was subject to certain conditions, including voluntary structural modifications such as divesting three Hindi general entertainment and film television channels. The CCI expressed concerns about the potential emergence of the resultant entity as the largest broadcasting house in India. Alongside divestment, the CCI imposed additional conditions to ensure fair market practices.

In March 2023, the CCI granted conditional approval for the 100% acquisition of Hindustan National Glass & Industries Limited (HNG) by AGI Greenpack Limited. However, this approval was contingent upon the divestiture of a manufacturing plant owned by HNG.

In August 2022, in the case of Umang Birla/Aditya Marketing, the CCI conditionally approved the merger. This approval was subject to voluntary behavioural remedies, including refraining from interference with the board of directors and management of certain affiliates of Umang Birla, which exhibited significant horizontal and vertical overlaps with Aditya Marketing. Additionally, the remedies required Umang Birla to reduce its shareholding in one of its affiliates to below 25%.

Given the similarities between the Reliance Disney merger and the Sony-Zee Merger and drawing from past precedents, the CCI may impose conditions such as divestment of certain business segments or other restrictions to address potential anti-competitive concerns and uphold fair market practices. These conditions serve to protect competition and consumer interests in the broadcasting sector, in accordance with the regulatory framework established by the CCI.

Further, any person or enterprise intending to enter into a proposed merger must submit a notice in the prescribed form within 30 days of the approval of such proposal by the directors or the execution of any agreement or other documents for such combination. Failure to provide notice to the commission may result in the imposition of a penalty by the commission, amounting to up to 1% of the total turnover or assets, whichever is higher, of such combination.

In the past, the CCI has imposed penalties in several cases including Bharti Airtel Limited with a penalty of Rs. 1 Crore, Hindustan Colas with Rs. 5 Lakh, Adani Transmission with Rs. 10 Lakh, Adani Green Energy with Rs. 5 Lakh, Chhatwal Group Trust with Rs. 10 Lakh and Zuari Fertilisers and Chemicals Limited and Zuari Agro Chemicals with Rs. 3 crores.

Looking ahead, as India’s M&A activity continues to evolve, adherence to regulatory requirements and cooperation with regulatory authorities will remain paramount. The CCI has demonstrated its effectiveness as a competition regulator in India, particularly as the country’s competitiveness has surged in recent years.

Through its open-door approach, in contrast to other regulatory bodies, the CCI maintains accessibility to address inquiries and apprehensions from stakeholders engaged in mergers. This approach fosters a more transparent and foreseeable regulatory framework for businesses navigating India’s emerging M&A landscape.